The Sciences are generally defined as ‘rigorous, systematic endeavor[s] that build and organize knowledge in the form of testable explanations and predictions about the world.’ As a Social Science, Economics focuses on ‘the production, distribution, and consumption of goods and services.’ As a Science, we would expect that Economics would be able to make testable predictions, and that over time, those theories would converge and those predictions would become more accurate.[0]

However much improvement there has been in economic theories over the past century or two, there is still no real consensus on the causes of and solutions for such basic economic issues as high inflation.[1]

So, why is this? A number of ideas come to mind, of varying levels of spiciness:

1) Economics lacks predictive power, and can only rationalize cause and effect after the fact

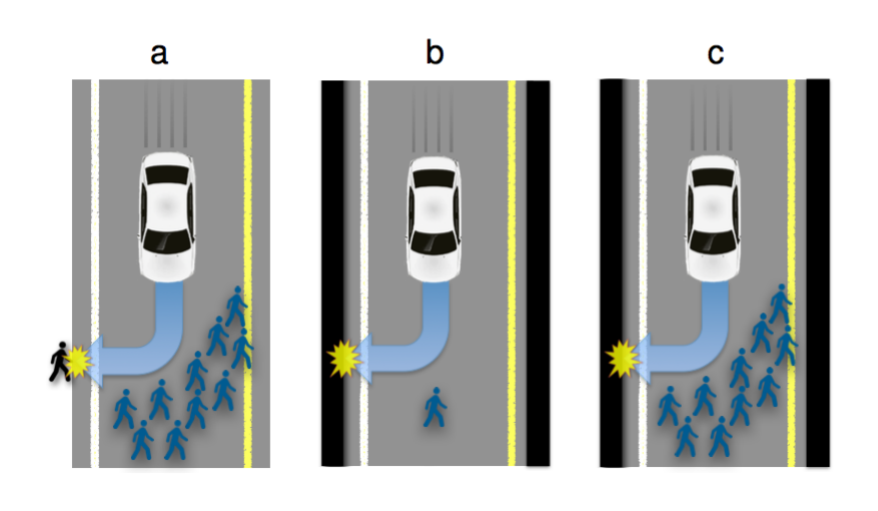

2) Human behaviour is too complicated to model (this Guardian article suggests that it might be a chaotic system)

3) Basic underlying assumptions are wrong (Humans are not rational actors, there is substantial information asymmetry, etc…)

4) Some combination of payola and regulatory capture (the current consensus on drivers of inflation does not take into account changes in corporate profit rates. Also note that the economics ‘Nobel Prize’ is not a true Nobel prize, and has been disowned by multiple members of the Nobel family[2].)

5) Different economic theories are required for different situations (read ‘Micro’ & ‘Macro’)

6) Economic theory is actually game theory, and as soon as something is figured out, humans compensate for that and change the rules (any large institution that you are trading with will adjust their prices (or other rules) if you figure out how to retain a larger percentage of the profit from a transaction, so as to maintain their margins)[3]

7) Much of human behaviour (and economic behaviour) is based on human sentiment, and measuring and reporting on it affects it (try watching how swings in price fluctuate vs. accepted measures of value for stocks as ‘market sentiment’ changes; cf. ‘Mr. Market‘)

8) Economic predictions are subject to ‘groupthink‘[4], as there are immediate consequences of being outside the mainstream, but few consequences for wrong predictions.

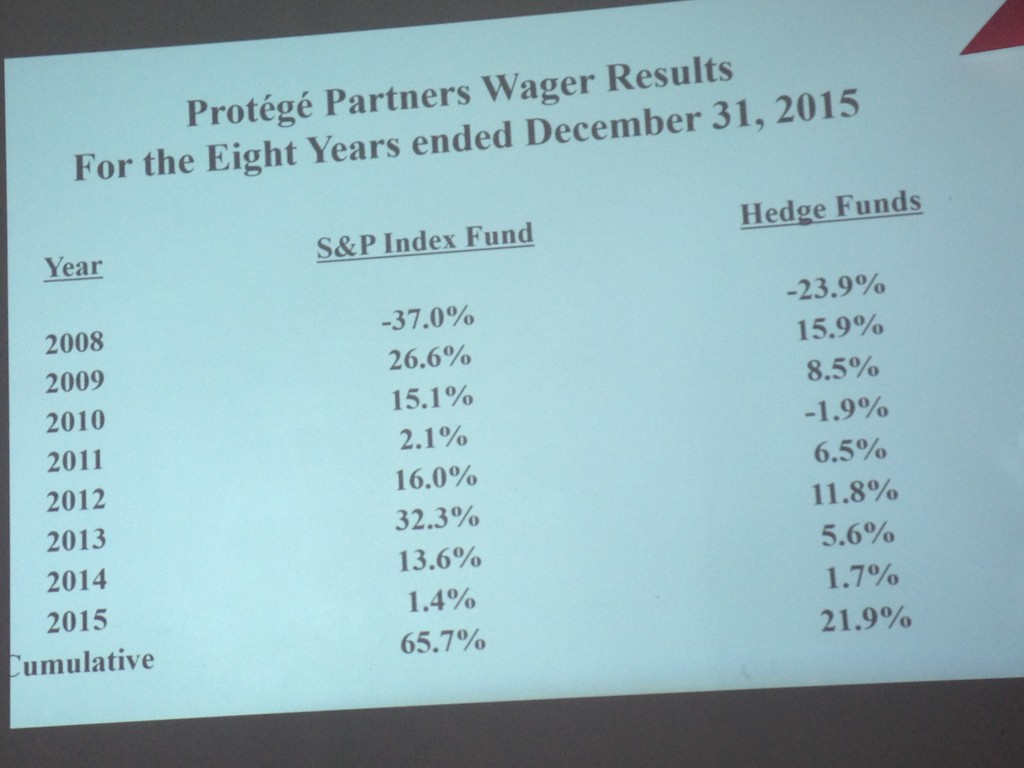

9) The returns from investing are directly at odds with the amount of profit made by investment advisors (see Warren Buffet’s successful bet with the Hedge funds for a good example)[5]

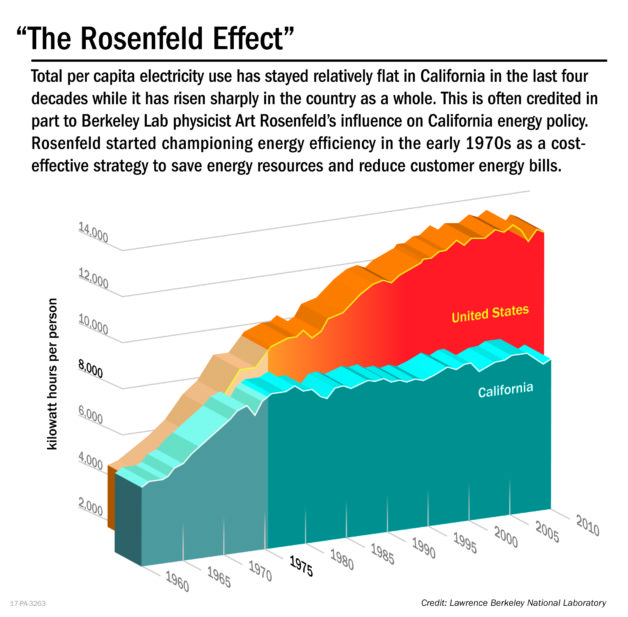

10) The inputs and ‘externalities’ are not things that most humans would choose (climate change is the current most pressing ‘externality’[6] that economic does not deal with well, but the original reason that economics was called a ‘dismal science‘ is another.)

So, which of the above are the main issues with Economics? Some of them? All of them? More importantly, what do we do about it?

Well, we can start by only believing theories that have been confirmed through the scientific method, i.e. Prediction, followed by successfully predicted result. Perhaps we can be more aware of sentiment or groupthink, and try to pay attention to the underlying.

(Just remember the famous quote attributed to Keynes: “Markets can remain irrational a lot longer than you and I can remain solvent.”

Other ideas on what are the main causes? Other recommendations on how to deal with them? Let me know in the comments below!

[0] There is one Theory of Gravity (modulo quantum), and one Theory of Evolution, and each of them have massive predictive power. Why not Economics?

[1] Note the three main determinants of inflation mentioned do not include ‘too much growth in the money supply’, or ‘price gouging’, generally accepted to be a major cause of the 2021-2022 (and perhaps ongoing) inflation surge.

[2] “Nobel accuses the awarding institution of misusing his family’s name, and states that no member of the Nobel family has ever had the intention of establishing a prize in economics.[39] He explained that “Nobel despised people who cared more about profits than society’s well-being”, saying that “There is nothing to indicate that he would have wanted such a prize”, and that the association with the Nobel prizes is “a PR coup by economists to improve their reputation”.[38] ”

Economics

[3] This is based on my experiences in Forex. I imagine other markets would be similar, but the less regulated the market, and the greater the power asymmetry, the worse this issue would be.

[3] “His analysis revealed that economists had failed to predict 148 of the past 150 recessions. Part of the problem, he said, was that there wasn’t much of a reputational gain to be had by predicting a recession others had missed. If you disagreed with the consensus, you would be met with skepticism. The downside of getting it wrong was more personally damaging than the upside of getting it right.”

[4] In case of link rot.

[5] Note that for example, the IMF focuses on the effects of Climate Change (and specifically says it is a ‘global externality’, rather than wielding its considerable power to propose policy changes that might reduce it.

” Climate and the Economy

Climate change has potential to do significant economic harm, and poses worrying tail risks. It is a global externality—one country’s emissions affect all countries by adding to the stock of heat-warming gases in the earth’s atmosphere from which warming arises.

The process of climate change is set to have a significant economic impact on many countries, with a large number of lower income countries being particularly at risk. Macroeconomic policies in these countries will need to be calibrated to accommodate more frequent weather shocks, including by building policy space to respond to shocks. Infrastructure will need to be upgraded to enhance economic resilience.

Elsewhere, climate change can entail significant risks to macrofinancial stability. Nonfinancial corporate sectors face risks from climate damages and stranded assets—such as coal reserves that become uneconomic with carbon pricing—and the disruption could affect corporate balance sheet quality.”