Yesterday, we watched the first half of the Q&A at the annual Berkshire Hathaway meeting. We ‘live’ blogged the first quarter of yesterday. Today, here’s the second quarter:

Q10: Negative rates, and how they affect Berkshire:

Charlie:

1/4 to -1/4 is not very different. Both are ‘painful’ interest rates for investing $60 billion

Charlie Munger looks like a sea turtle.

Charlie seems to drink a lot of Coke, don’t know if Warren does, but that could just because Warren is the one talking most of the time.

Q11: BNSF Decline in commodity prices, and how that might change how much freight is shipped

“We don’t mark up and down our wholly-owned businesses based on motions in the stock market.”

Q12:Harry Potter(?!?) question? (The question asker compared the situation to Hogwarts, etc…)

How should children look at stocks when time horizons for ‘investing’ so short, and IPOs are making so much money?

(On IPOs)

‘If they want to do mathematically unsound things and one of them gets lucky and they put the one that’s lucky on television…’

Think of stocks as a business you own…

Charlie:

‘American business will do fine’

‘But not the average client of a stockbroker.’

‘The stockbroker will do fine’

Q13: NV lobbying against solar (rooftops) where the utility was forced to pay the increased rate to the homeowner instead of the government?

‘Who pays the subsidy’ is the issue… (‘A political question’)

‘If society is the one benefiting, then society should pick up the tab.’

Q14: Low oil prices influence BRK more now (because of various effects on various subsidiaries)?

Warren:

‘We don’t think we can predict the price of commodities.’

Charlie:

‘I’m even more ignorant than you are.’

Q15: Would philanthropic establishment of new universities help with the cost of tuition, possibly by supply/demand?

Charlie:

‘If you expect financial efficiency in american higher education, you’re howling at the wind’

‘Glory of civilization’ (universities)

‘Monopoly and bureaucracy’ (description of universities)

We (USA) spend a lot of money on higher education. Being cheap is not our issue.

Charlie:

‘I’ve made all the enemies I can afford.’

Q16: On effects of Donald Trump on Berkshire

‘That won’t be the main problem’

Charlie:

‘I’m afraid to get into this area.’

Warren:

‘Business in this country has done extremely well for 200 years.’

Returns on tangible equity have not suffered while those on fixed income have suffered.

GDP/capita has gone up in real terms

‘System works very well in terms of output per capita, as far as distribution (inequality), there are often more issues.’

‘Charlie, give something pessimistic to balance me out.’

Charlie:

‘I don’t think the future is necessarily going to be as good as the past, but it doesn’t need to be.’

‘You’re making free choices that you couldn’t 20 years ago.’

Q17: Norfolk Southern/CP failed merger fallout?

BNSF: Certain tests needed to be passed before a large railroad merger would happen (good for public interest, good for shareholders, etc…). That merger may have been good for the shareholders, but did not meet the overall criteria. Next round of mergers will occur when population makes transportation more scarce.

Q18: How do you feel about investment banks not being able to make as much money?

After 2008-9, regulations to increase capital requirements, particularly on larger banks….

‘You can change the math of banking and profitability of banking by changing capital requirements.’

100% capital requirement means not very profitable, 1% capital requirements causes huge problems

Investment banking not a thing we invest in.

Charlie:

‘Generally, we fear the genre more than we love it.’

Q19: Activist investor targeting if BRK trades at a discount to intrinsic value?

Defend by size, and by having money to buy shares at less than intrinsic value.

‘The numbers involved would be staggering.’

Mid-America does better by not being split up.

1973-1974 very good companies selling at a steep discount to what they’re worth… (When stocks at a discount, money is hard to come by)

Charlie:

We don’t worry about this and others do, they can get attacked by hostile takeovers/etc, and we can’t

‘…and you want a strong ally, how many people would you pick in preference to BRK?’

Q20: Leasing?

Train cars… Bank has lower cost of funds than we do

‘A trillion dollars, at 10 basis points’

Aircraft leasing not interesting…

‘We’re well located now, but I don’t think we have new opportunities.’

Q21: Which competitor would you take out and why

Charlie:

‘I don’t think we have to answer this one.’

‘Widening the moat’ is the goal.

‘Not trying to target competitors, just trying to do the best everywhere.’

Warren:

‘Spoken like an anti-trust lawyer’

Q22: Sequoia, and Valeant position

The guy we trusted and recommended passed away in 2005.

The manager involved is no longer in charge.

‘If you have a manager, and doesn’t have integrity, make sure they’re dumb and lazy.’

‘Pattern recognition is very important in evaluation of humans and business.’

‘Frequently come to a bad end, but frequently looks good in the short term.’

Charlie:

‘Valeant of course was a sewer.’ (And they deserved what they got.)

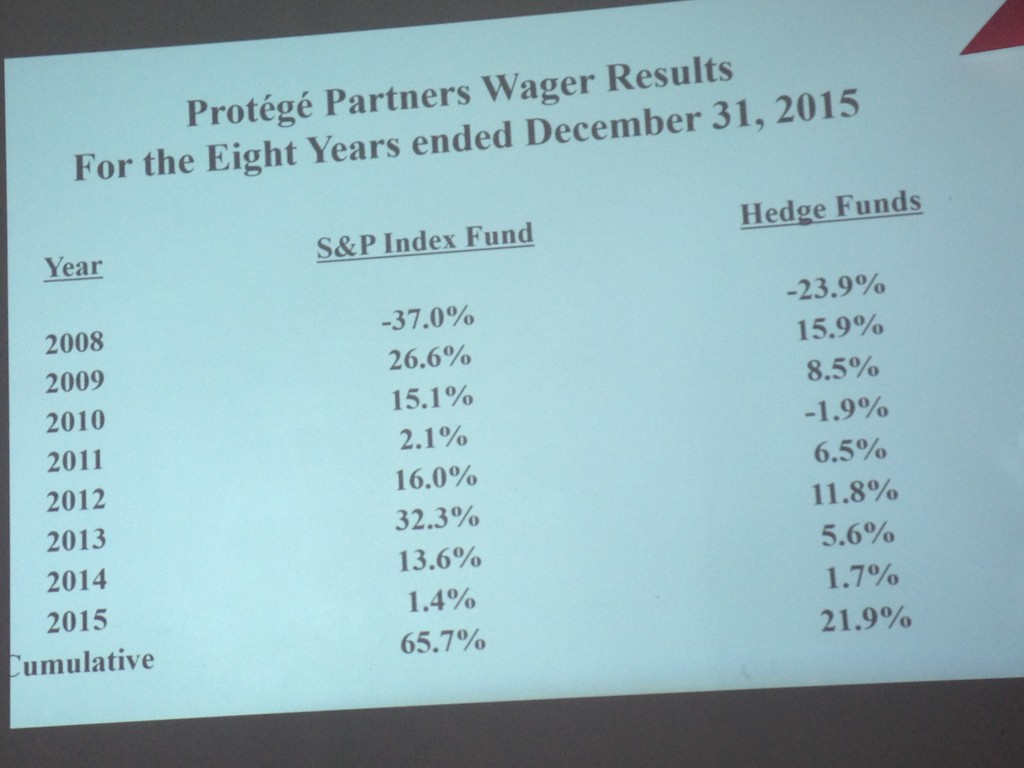

Just before lunch, they put up the interim results of a wager between Buffet and a money management firm.

Protege Partners Wager Results (longbets.org)

Hedge funds of funds vs. S&P500 index funds

‘That might sound like a terrible result for the hedge funds, but it’s not a terrible result for the hedge fund managers.’

‘180 million dollars a year, merely for breathing.’ (If Berkshire compensated 2&20.)

‘They can’t believe that they can’t hire someone to make them more money than average.’

‘Consultants can’t change too much year to year, because it looks like they don’t know what they’re doing.’

‘Charlie, do you have anything to add to my sermon?’

‘A tiny group of people.’ (Who can manage money consistently better)

‘Far far far more money made on Wall Street by sales abilities than investment abilities.’