During the last Canadian federal election, two of the three major parties made electoral reform* part of their platform.

The goal was to find a better system for electing members of parliament than the current ‘first past the post’ system. Under the current system, a candidate can win a seat with (28.6%) of the votes in that riding[1], and a party can win a majority of the seats in the country (54%) with a bare plurality (39.5%) of the popular vote.

This tends to lead to voter disillusionment, as many voters (rightly) believe that their vote has no chance of influencing an election. The ‘Per Vote Subsidy‘ was one attempt to rectify this, by counting votes to fund political parties, so voters could feel that no matter where they were voting, their vote was doing something.

So, we want to change this system. What do we want out of a voting system?

At its most fundamental, the goal of a voting system is to provide a system for a peaceful transition of power. The way voting systems do this is by making people feel like they have a say in that transition of power.

At the same time, you want the system to be quick, fair, and resistant to cheating (as there are millions of lives and hundreds of billions of dollars at stake).

(I’m also assuming that we will continue to have a representative democracy, and the number of representatives will remain approximately the same. I’m also assuming that there will be political parties in whatever new system we come up with.)

So: having a say, quick, fair, representative, and resistant to cheating.

Having a say:

– Each vote should have the highest probability possible of changing the representation of the House of Commons

Quick:

– The public should know the results within hours of the polls closing.

Fair:

– Political parties should not be significantly inconvenienced by the electoral system for not having money.

– Any barriers to entry should be reasonable (number of candidates to be a registered party, number of votes to get deposits back, percentage of popular vote to qualify to get seats, etc…)

– The system should not unduly give power to very small groups (49/49/2 split, the 49 and 2 have equal power).

– The system should be ‘simple enough’ for people to understand. Currently, people vote for one person, one party with the same vote. A similar system being successfully used elsewhere in the world is a reasonable way to determine ‘simple enough’.

Representative:

– There are a number of ways to be representative:

– Geographically

– Representation of party by population

– Minority groups

– Diversity of opinions

Resistant to cheating:

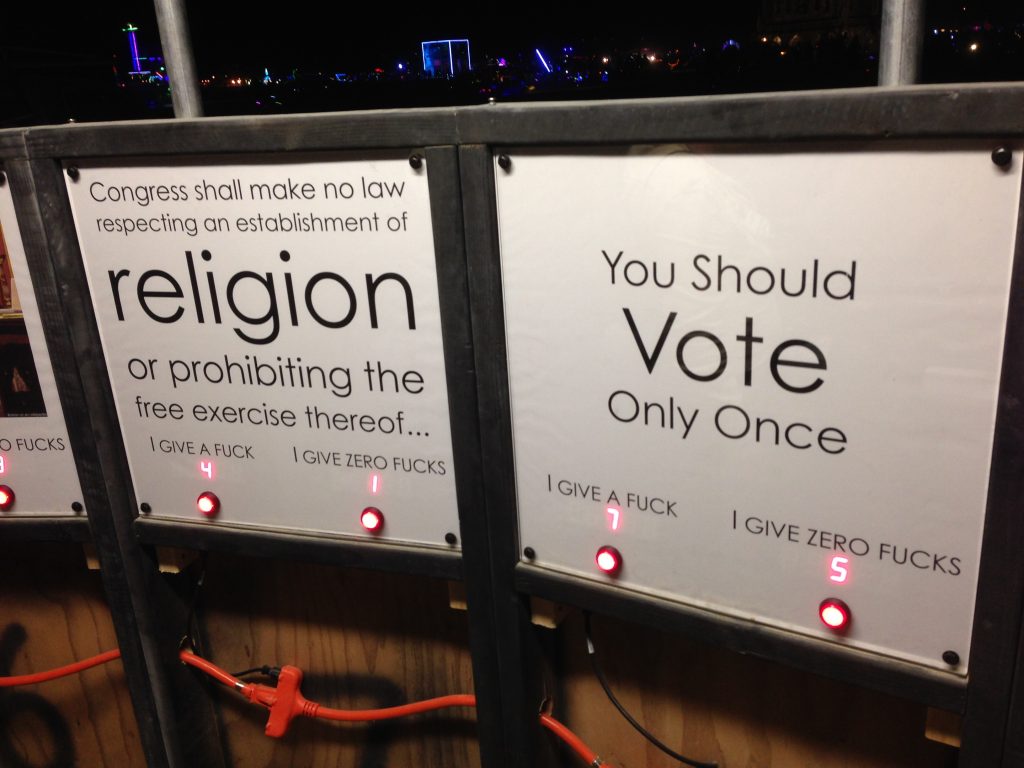

– Secret ballot to reduce intimidation and coercion as factors

– Reasonable voter ID laws to increase voter turnout while keeping the risk of personation low.

– Distributed counting makes the current system quite resistant to cheating. One would have to mess with the voting tally computers in real-time to change this. The fact that there is an anonymous paper record of every vote cast in the ballot boxes is also an important check on this system.

Interestingly, the current system seems to do most of the above well, except for representative part (and the current voter ID laws).

Next time, we’ll look at a list of options to increase the representativeness, and see how they affect the rest of the criteria.

[1]Far more likely to induce voter disillusionment is when the party or parties that a voter supports has no way of winning a seat, such as the Conservative party in Trinity-Spadina, or the Liberals or NDP in Red Deer.